BTC Halving Season & The ETH / ATOM / DOT Sell Ladder

📈 Z-Finance

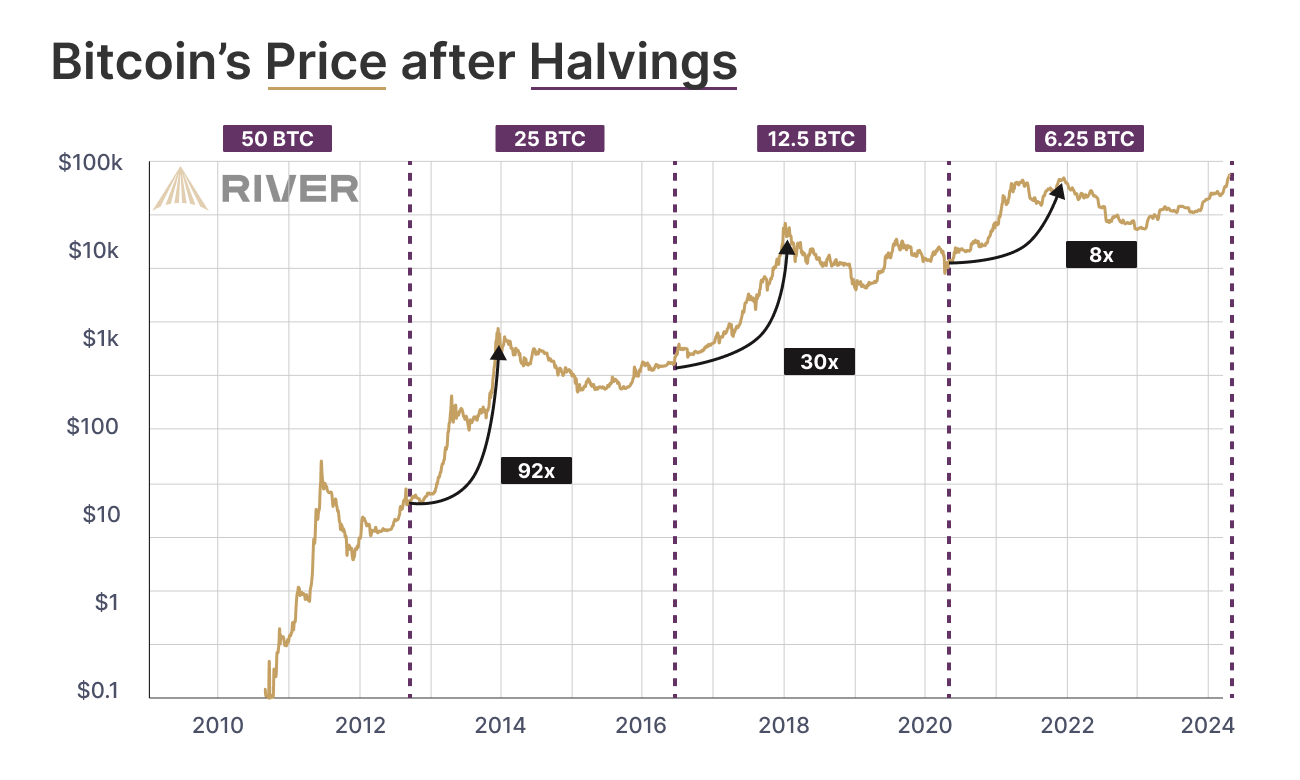

The last Bitcoin halving was April 19, 2024 — the supply shock that resets the game every four years.

Every 210,000 blocks, the network cuts the block reward in half. That means miners suddenly earn 50% less BTC for the same work. Supply tightens overnight while demand stays steady or grows. It’s programmed scarcity — monetary policy written in code.

Every past cycle has played the same way: quiet accumulation before the halving, breakout around the event, mania roughly a year later. The pattern repeats because incentives don’t change — fewer new coins hitting the market, more buyers chasing them.

Right now we’re in the transition phase. BTC has already set a new baseline above the old cycle highs. Institutions are buying. The narrative is heating up. But we’re not in euphoria yet — this is still the climb.

That means two things:

Patience while the world wakes up.

Discipline to stick to the plan once the mania hits.

I’m not trying to be the guy who “held forever” and bragged on Twitter, only to watch paper gains evaporate. I’m playing for sovereign freedom. That means a plan. That means discipline.

Principle: You don’t guess tops. You ladder exits.

As BTC drags the market into euphoria, alts will pump hardest, fastest, and most irrationally. That’s where I’ll be taking chips off the table — not because I hate money, but because I love staying in the game.

Here’s how I’m structuring it:

Ethereum (ETH)

First trims at 10% of stack

Another 13–15% when price breaks into mid-range

Then 20% slices as we climb the ladder

Final trim ~15% of stack at peak targets

Why? ETH is the blue-chip alt. The higher it goes, the more liquidity I’ll harvest.

Cosmos (ATOM)

Start light: 10% off at first pump

Build into 15–20% sells as momentum runs

Final slice is another 15%, because ATOM is high-beta but still lagging in adoption.

Why? This is an ecosystem play. I’ll milk the volatility while it’s hot.

Polkadot (DOT)

10–15% off early to lock small wins

20% slices through the core of the ladder

Wrap with another 15% at the peak tier.

Why? DOT is speculative. I’ll play it like a casino table — in, out, gone.

The Math of Survival

The ladder averages out to:

Roughly 10–15% sells early → cover emotions, free up cash.

Then 20% chunks through euphoria → catch irrational highs.

End with a final 15% trim → make sure I don’t “round trip” my stack.

If all targets hit, the portfolio 2.5–3x’s. More importantly: I’ll have liquid cash, debt cleared, and dry powder to reload in the crash.

Final Note

Most men will get drunk on green candles. They’ll call you weak for selling. Then they’ll cry in the bear market.

The sovereign man sells strength. Not weakness.

Halving season isn’t the time to gamble. It’s the time to cash in. I’ll break down exactly how to set limit sell orders on Coinbase in a future dispatch.

This Dispatch slipped through the gates.

The next might vanish behind the 🔒.

The real Zaddy systems live underground —

Field-tested tactics for sovereign men rebuilding in the collapse.

From the Vault:

The Heartiste Maxims • The Desi Playboy Manual • The Bonecrker Codex — free download

Try Zaddyline Beta: the sovereign-dad assistant — Child Support Tracker + SoberLink Tracker + Weekly Routine + Deadbeat Zaddy Chatbot for the rebuild. Launch →