Age of Money: Letting Your Cash Marinate

📈 Z-Finance

Back when I was married, my wife and I ran what looked like a responsible setup.

We used a joint checking account for bills and shared expenses. 50% of each paycheck went straight into that account. The rest landed in our personal checking accounts—mine mostly for discretionary spending. “Play money,” loosely defined.

On paper, it felt clean.

In practice, it was opaque.

I had no real visibility into where the money was going. Traditional budgeting felt tedious and reactive. I wanted signal, not spreadsheets. Around that time, I’d heard good things about YNAB (You Need a Budget), so I set it up and taught my wife the method — not to micromanage, but to finally see our cash flow clearly.

There was a learning curve.

But it worked.

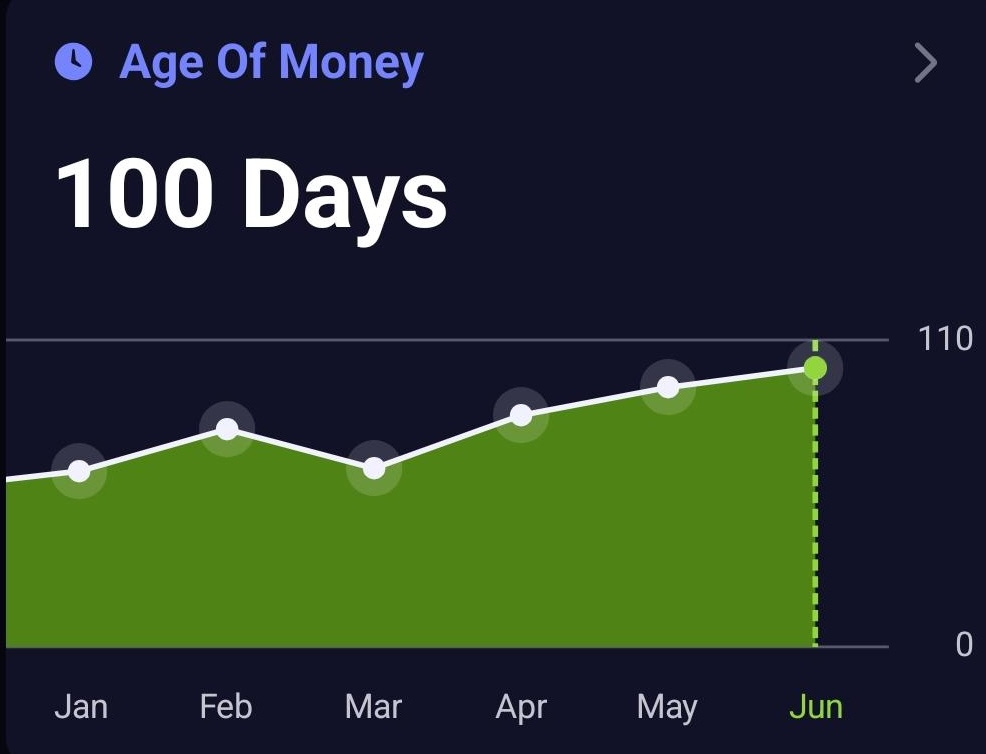

Here’s what stuck with me: no matter what we did, our Age of Money plateaued around 25 days.

Then our daughter Nina was born.

Expenses rose. Anxiety rose with them. My wife wanted to increase our joint contribution from 50% to 60%. Her logic was simple: more buffer, more safety.

Mine was simpler:

Are we actually getting ahead — or just moving money faster?

I couldn’t tell.

And that was the problem.

I wasn’t resisting responsibility. I was resisting blindness. Was this the right move, or was I just complying because it sounded prudent?

That’s when it clicked.

Most people think they have a money problem.

What they actually have is a timing problem.

That’s where Age of Money becomes a cheat code.

It tells you something traditional budgeting never does:

How long your dollars survive before they’re spent.

This single number reveals everything:

your financial stress

your fragility

your margin for error

and how close you are to running your life instead of reacting to it

What Age of Money Actually Measures

If your Age of Money is 5 days, you’re spending money that arrived five days ago.

If it’s 45 days, you’re spending money earned over a month ago.

This metric is not emotional.

It’s not a vibe.

It’s cash-flow truth serum.

Age of Money answers one question honestly:

How much time do you have if nothing goes right?

What Is a “Good” Age of Money?

Use this scale:

0–14 days

Paycheck to paycheck. One surprise bill cracks the month.

15–29 days

You can breathe, but you’re exposed. A curveball still rattles you.

30–59 days

Stable. You’re spending last month’s money this month.

60–120 days

Strong footing. Money works for you, not the other way around.

120+ days

Day-to-day financial sovereignty. Income could pause and life wouldn’t immediately collapse.

A man who hits 30+ days exits reaction mode.

At 60+ days, disruptions stop feeling urgent.

At 120+ days, calm becomes default.

Your Age of Money isn’t a flex.

It’s your internal liquidity score, updated daily.

Age of Money vs. Emergency Fund

Most advice pushes the classic rule:

“Save 3–6 months of expenses in an emergency fund.”

That advice is fine.

It’s also incomplete.

Emergency Funds Are Static. Age of Money Is Dynamic.

An emergency fund sits untouched in a savings account.

Age of Money updates every time you earn or spend.

One measures potential resilience.

The other measures real-time breathing room.

Emergency Funds Are Backward-Looking. Age of Money Is Habit-Driven.

You can have six months saved and still feel stressed if your spending discipline is sloppy.

Age of Money exposes:

overspending

impulse buying

lifestyle creep

poor category planning

You can’t fake it. It reflects how you actually live.

Emergency Funds Protect Against Disaster.

Age of Money Protects Against Stress.

Delayed paychecks.

Bills arriving early.

Unexpected repairs.

Child-related surprises.

Age of Money absorbs daily chaos before it becomes panic.

Emergency Funds Require Big Savings.

Age of Money Requires Better Timing.

You don’t need an extra $10,000 to increase your Age of Money.

You need to:

stop spending money the moment it arrives

budget only what you actually have

let dollars age before use

build buffer intentionally

Small timing improvements compound faster than raises.

When Age of Money Becomes an Emergency Fund

Here’s the part most people miss.

If your Age of Money is 90–180 days, you already functionally have an emergency fund.

It’s just distributed, not siloed.

You’re spending money earned months ago.

Your checking, savings, and buffers work together.

You’re not dependent on the next paycheck to survive.

That’s why men with high Age of Money feel calm even without a giant “Emergency” category.

They’re already living ahead of problems.

The Hybrid Truth

A separate emergency fund still has value:

psychological clarity

easier communication

protection from self-sabotage

But the clean framing is this:

Your emergency fund should count toward your Age of Money.

The real question isn’t:

“Do I have an emergency fund?”

It’s:

“If income stopped today, how long would my money last?”

30 days: fragile

90 days: stable

180+ days: sovereign

How to Increase Your Age of Money

This is the Z-Finance method:

Budget only money you actually have

Reduce high-drain categories first

Slow purchases by one pay cycle

Pay bills with old dollars

Fund next month before optimizing this one

Hit 30 days and momentum takes over.

Why Age of Money Beats Minimalism, FIRE, and “Skip Coffee” Math

Minimalism reduces clutter.

FIRE optimizes retirement.

Skipping coffee changes almost nothing.

Age of Money reduces stress.

It gives you:

space

delay

cushion

You stop refreshing your bank app like a threat feed.

You stop fearing bad timing.

You stop living one mistake away from collapse.

The Deadbeat Conclusion

Age of Money isn’t about being rich.

It’s about being unrushed.

It proves:

you’re not in survival mode

your cash flow is disciplined

you have margin

you can breathe

In finance — and in life — sovereignty begins with space.

Age of Money is the metric that tells you whether you have any.

PS

If anything here hits close to home and you want to talk it through privately, just reply to this email.

Tool I Use

I use YNAB to track and build my Age of Money.

If you want to see your real cash buffer instead of guessing, you can try it here:

👉 YNAB

This Z-Finance article slipped through the gates.

The next might vanish behind the 🔒.

The real Zaddy systems live underground —

Field-tested tactics for sovereign men rebuilding in the collapse.

From the Vault:

The Heartiste Maxims • The Desi Playboy Manual • The Bonecrker Codex — free download

Z-Ledger:

A private net worth & financial clarity tool I use to track the rebuild.

Launch →

I thought I was alone thinking like this. Excellent article